Ekinci, Mehmet Fatih

Loading...

Profile URL

Name Variants

Ekinci, Mehmet Fatih

Ekinci M.

Ekinci,M.F.

Mehmet Fatih Ekinci

M.,Ekinci

M. F. Ekinci

E.,Mehmet Fatih

E., Mehmet Fatih

Ekinci,Mehmet Fatih

M.F.Ekinci

M., Ekinci

Mehmet Fatih, Ekinci

Ekinci, M. Fatih

Ekinci M.

Ekinci,M.F.

Mehmet Fatih Ekinci

M.,Ekinci

M. F. Ekinci

E.,Mehmet Fatih

E., Mehmet Fatih

Ekinci,Mehmet Fatih

M.F.Ekinci

M., Ekinci

Mehmet Fatih, Ekinci

Ekinci, M. Fatih

Job Title

Doçent Doktor

Email Address

fatih.ekinci@atilim.edu.tr

Main Affiliation

Economics

Status

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

1

NO POVERTY

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

1

Research Products

10

REDUCED INEQUALITIES

4

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

1

Research Products

14

LIFE BELOW WATER

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

3

Research Products

Documents

11

Citations

38

h-index

3

Documents

10

Citations

46

Scholarly Output

14

Articles

6

Views / Downloads

86/621

Supervised MSc Theses

5

Supervised PhD Theses

0

WoS Citation Count

12

Scopus Citation Count

15

WoS h-index

2

Scopus h-index

2

Patents

0

Projects

1

WoS Citations per Publication

0.86

Scopus Citations per Publication

1.07

Open Access Source

4

Supervised Theses

5

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| Applied Economics | 1 |

| Applied Operations Research and Ficial Modelling in Energy: Practical Applications and Implications | 1 |

| Business and Economics Research Journal | 1 |

| Economic Analysis and Policy | 1 |

| Economic Growth and Ficial Development: Effects of Capital Flight in Emerging Economies | 1 |

Current Page: 1 / 2

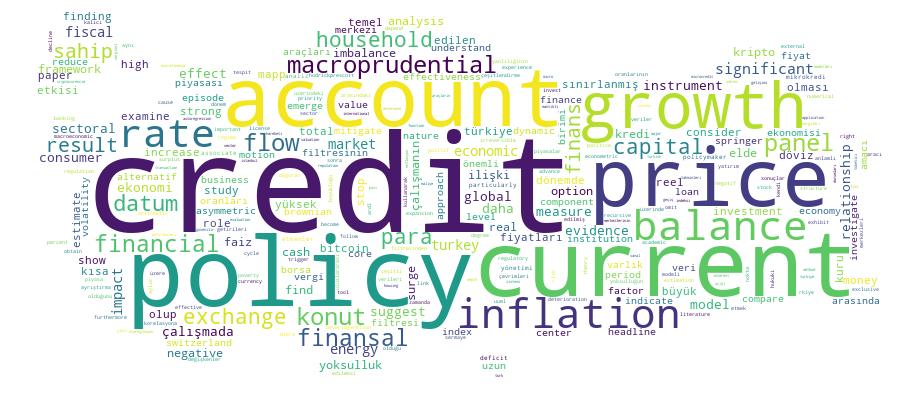

Competency Cloud