Ünlü, Kamil Demirberk

Loading...

Profile URL

Name Variants

Kamil Demirberk, Unlu

Unlu,K.D.

Unlu, Kamil Demirberk

U., Kamil Demirberk

K.D.Unlu

Ünlü,K.D.

Ü.,Kamil Demirberk

K.D.Ünlü

Kamil Demirberk, Ünlü

K. D. Unlu

U.,Kamil Demirberk

K.,Ünlü

Ünlü, Kamil Demirberk

Unlu K.

Unlu, K. D.

Ünlü K.

K., Unlu

Ü., Kamil Demirberk

K. D. Ünlü

Unlu,K.D.

Unlu, Kamil Demirberk

U., Kamil Demirberk

K.D.Unlu

Ünlü,K.D.

Ü.,Kamil Demirberk

K.D.Ünlü

Kamil Demirberk, Ünlü

K. D. Unlu

U.,Kamil Demirberk

K.,Ünlü

Ünlü, Kamil Demirberk

Unlu K.

Unlu, K. D.

Ünlü K.

K., Unlu

Ü., Kamil Demirberk

K. D. Ünlü

Job Title

Doçent Doktor

Email Address

demirberk.unlu@atilim.edu.tr

Main Affiliation

Industrial Engineering

Status

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

3

GOOD HEALTH AND WELL-BEING

3

Research Products

7

AFFORDABLE AND CLEAN ENERGY

5

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

5

Research Products

13

CLIMATE ACTION

1

Research Products

14

LIFE BELOW WATER

1

Research Products

This researcher does not have a Scopus ID.

Documents

17

Citations

193

Scholarly Output

21

Articles

16

Views / Downloads

81/180

Supervised MSc Theses

1

Supervised PhD Theses

0

WoS Citation Count

191

Scopus Citation Count

205

WoS h-index

9

Scopus h-index

9

Patents

0

Projects

0

WoS Citations per Publication

9.10

Scopus Citations per Publication

9.76

Open Access Source

8

Supervised Theses

1

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| Journal of Applied Statistics | 2 |

| Modeling and Advanced Techniques in Modern Economics | 2 |

| Atmospheric Environment | 1 |

| Balıkesir Üniversitesi Fen Bilimleri Enstitüsü Dergisi | 1 |

| Communications Faculty of Sciences University of Ankara Series A1: Mathematics and Statistics | 1 |

Current Page: 1 / 4

Scopus Quartile Distribution

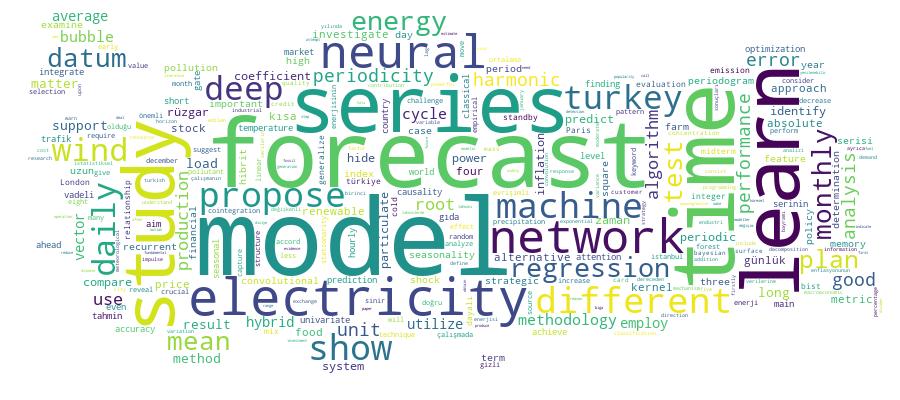

Competency Cloud

21 results

Scholarly Output Search Results

Now showing 1 - 10 of 21

Book Part Determining Harmonic Fluctuations in Food Inflation(World Scientific Publishing Co., 2022) Akdi,Y.; Ünlü,K.D.; Baş,C.; Karamanoğlu,Y.E.In this study, we start with a brief expression of consumer price index of Turkey. In the next step, we give the theoretical essentials of periodogram-based unit root and harmonic regression model. Periodogram-based unit root test is used to identify both the stationarity of data and periodicities. Periodicity is beyond seasonality; it is the hidden cycles in the data. Thus, it is harder to detect them compared to seasonal cycles. Harmonic-regression-type trigonometric regression models are useful in modeling data which have hidden periodicity. Afterward, the stationarity properties of monthly inflation and monthly food inflation of Turkey for the period between 2004 and 2020 are investigated. Standard augmented Dickey-Fuller unit root test shows that both series are integrated of order one. However, the periodogram-based unit root test shows that monthly inflation has unit root but monthly food inflation does not. After examining the unit root, the hidden cycles in the food inflation are revealed. The cycles in food inflation are important because they may trigger a headline inflation. The main contribution of this study is the identification of the hidden cycles in food inflation. It has cycles of approximately two, four, six and eight years. These cycles, in short, correspond to cycles of two years of consecutive periods. © 2022 by World Scientific Publishing Europe Ltd.Article Citation - WoS: 1Citation - Scopus: 1Wavelet-Enhanced Sequence-To Modeling With Attention Mechanism for Short-Term Wind Power Forecasting(Taylor & Francis inc, 2025) Karaca, Burak; Unlu, Kamil Demirberk; Turkan, SemraElectricity load forecasting is crucial to managing electric systems, especially loads produced from renewable energy sources since the load from renewable energy sources varies when compared with nonrenewable sources. Turkey is producing an increasing amount of electricity from wind energy every day. The aim of this study is to introduce a hybrid deep learning model based on sequence-to-sequence learning (seq-2-seq), attention mechanisms, and wavelet transformation. Long Short-Term Memory (LSTM), Gated Recurrent Unit, and Bidirectional Long Short-Term Memory (BiLSTM) are used as decoders and encoders in the seq-2-seq model. We proposed six different models. All models are univariate type, requiring only the data itself. The model can be used on any wind farms without requiring the meteorological data. We test the proposed model on four different wind farms in Turkey: Soma, Biga, Balikesir, and Mersin. We utilize four different performance metrics to test the model's performance: mean squared error (MSE), mean absolute error (MAE), mean absolute percentage error (MAPE), and coefficient of determinations (R2). The best model is seen as Wavelet-Seq2Seq-BiLSTM-LSTM at Biga Wind Farm, which achieved the best performance with a MAE of 0.127, an MSE of 0.001, a MAPE of 0.28, and an R2 of 0.997.Article Citation - WoS: 17Citation - Scopus: 18Daily Pm10, Periodicity and Harmonic Regression Model: the Case of London(Pergamon-elsevier Science Ltd, 2020) Okkaoglu, Yasin; Akdi, Yilmaz; Unlu, Kamil DemirberkOne of the most important and distinguishable features of the climate driven data can be shown as the seasonality. Due to its nature air pollution data may have hourly, daily, weekly, monthly or even seasonal cycles. Many techniques such as non-linear time series analysis, machine learning algorithms and deterministic models, have been used to deal with this non-linear structure. Although, these models can capture the seasonality they can't identify the periodicity. Periodicity is beyond the seasonality, it is the hidden pattern of the time series. In this study, it is aimed to investigate the periodicity of daily Particulate Matter (PM10) of London between the periods 2014 and 2018. PM10 is the particulate matter of which aerodynamic diameter is less than 10 mu m. Firstly, periodogram based unit root test is used to check the stationarity of the investigated data. Afterwards, hidden periodic structure of the data is revealed. It is found that, it has five different cycle periods as 7 days, 25 days, 6 months, a year and 15 months. Lastly, it is shown that harmonic regression performs better in forecasting monthly and daily averages of the data.Article Citation - WoS: 15Citation - Scopus: 18Forecasting Air Quality in Tripoli: an Evaluation of Deep Learning Models for Hourly Pm2.5 Surface Mass Concentrations(Mdpi, 2023) Esager, Marwa Winis Misbah; Unlu, Kamil DemirberkIn this article, we aimed to study the forecasting of hourly PM2.5 surface mass concentrations in the city of Tripoli, Libya. We employed three state-of-the-art deep learning models, namely long short-term memory, gated recurrent unit, and convolutional neural networks, to forecast PM2.5 levels using univariate time series methodology. Our results revealed that the convolutional neural networks model performed the best, with a coefficient of variation of 99% and a mean absolute percentage error of 0.04. These findings provide valuable insights into the use of deep learning models for forecasting PM2.5 and can inform decision-making regarding air quality management in the city of Tripoli.Article Citation - WoS: 20Citation - Scopus: 23A New Generalized Δ-Shock Model and Its Application To 1-out-of-(m+1):g Cold Standby System(Elsevier Sci Ltd, 2023) Eryilmaz, Serkan; Unlu, Kamil DemirberkAccording to the classical delta-shock model, the system failure occurs upon the occurrence of a new shock that arrives in a time length less than delta, a given positive value. In this paper, a new generalized version of the delta-shock model is introduced. Under the proposed model, the system fails if there are m shocks that arrive in a time length less than delta after a previous shock, m >= 1. The mean time to failure of the system is approximated for both discretely and continuously distributed intershock time distributions. The usefulness of the model is also shown to study 1-out-of-(m + 1):G cold standby system. Illustrative numerical results are presented for geometric, exponential, discrete and continuous phase-type intershock time distributions.Book Part Forecasting the Bist 100 Index With Support Vector Machines(World Scientific Publishing Co., 2022) Ünlü,K.D.; Potas,N.; Ylmaz,M.Recent literature shows that statistical learning algorithms are powerful for forecasting financial time series. In this study, we model and forecast the Borsa Istanbul 100 Index by employing the machine learning algorithm, support vector machine. The dataset contains the highest price, lowest price, closing price and volume of the index for the period between July 2020 and June 2021.We utilize three different kernels. The empirical findings show that linear kernel gives the best result with coefficient of determination of 0.91 and root mean square error of 0.0062. The second best is polynomial kernel, and it is followed by radial basis kernel. The study shows that statistical learning algorithms can be thought of as an alternative to classical time series methodology in forecasting financial time series. © 2022 by World Scientific Publishing Europe Ltd.Article Citation - WoS: 9Citation - Scopus: 9A Hybrid Deep Learning Methodology for Wind Power Forecasting Based on Attention(Taylor & Francis inc, 2024) Akbal, Yildirim; Unlu, Kamil DemirberkWind energy, as a sustainable energy source, poses challenges in terms of storage. Therefore, careful planning is crucial to utilize it efficiently. Deep learning algorithms are gaining popularity for analyzing complex time series data. However, as the "no free lunch" theorem suggests, the trade-off is: they need a lot of data to achieve the benefits. This even brings up a severe challenge for time series analysis, as the availability of historical data is often limited. This study aims to address this issue by proposing a novel shallow deep learning approach for wind power forecasting. The proposed model utilizes a fusion of transformers, convolutional and recurrent neural networks to efficiently handle several time series simultaneously. The empirical evidence demonstrates that the suggested innovative method exhibits exceptional forecasting performance, as indicated by a coefficient of determination (R2) of 0.99. When the forecasting horizon reaches 48, the model's performance declines significantly. However, when dealing with long ranges, utilizing the mean as a metric rather than individual point estimates would yield superior results. Even when forecasting up to 96 hrs in advance, obtaining an R2 value of 0.50 is considered a noteworthy accomplishment in the context of average forecasting.Conference Object Forecasting Direction of Bist 100 Index: an Integrated Machine Learning Approach(Springer Science and Business Media B.V., 2021) Ünlü,K.D.; Potas,N.; Yılmaz,M.In recent years trends in analyzing and forecasting financial time series moves from classical Box-Jenkins methodology to machine learning algorithms because of the non-linearity and non-stationary of the time series. In this study, we employed a machine learning algorithm called support vector machine to predict the daily price direction of BIST 100 index. In addition, we use random forest algorithm for feature selection and showed that by removing some features from the model, performance of the model increases. © 2021, The Author(s), under exclusive license to Springer Nature Switzerland AG.Article Citation - WoS: 17Citation - Scopus: 21A Data-Driven Model To Forecast Multi-Step Ahead Time Series of Turkish Daily Electricity Load(Mdpi, 2022) Unlu, Kamil Demirberk; Ünlü, Kamil Demirberk; Ünlü, Kamil Demirberk; Industrial Engineering; Industrial EngineeringIt is critical to maintain a balance between the supply and the demand for electricity because of its non-storable feature. For power-producing facilities and traders, an electrical load is a piece of fundamental and vital information to have, particularly in terms of production planning, daily operations, and unit obligations, among other things. This study offers a deep learning methodology to model and forecast multistep daily Turkish electricity loads using the data between 5 January 2015, and 26 December 2021. One major reason for the growing popularity of deep learning is the creation of new and creative deep neural network topologies and significant computational advancements. Long Short-Term Memory (LSTM), Gated Recurrent Network, and Convolutional Neural Network are trained and compared to forecast 1 day to 7 days ahead of daily electricity load. Three different performance metrics including coefficient of determination (R-2), root mean squared error, and mean absolute error were used to evaluate the performance of the proposed algorithms. The forecasting results on the test set showed that the best performance is achieved by LSTM. The algorithm has an R-2 of 0.94 for 1 day ahead forecast, and the metric decreases to 0.73 in 7 days ahead forecast.Article TÜRKİYE'DEKİ TRAFİK KAZALARININ PERİYODİK YAPISININ ARAŞTIRILMASI(2021) Akdi, Yılmaz; Karamanoğlu, Yunus Emre; Ünlü, Kamil Demirberk; Baş, CemBu çalışmada, Türkiye'de 2019 yılında meydana gelen günlük trafik kazaları verilerine zaman serisi analizi uygulanmıştır. Çalışmada kullanılan verilerin en önemli özelliği kolluk birimleri tarafından günlük olarak tutulan resmi trafik kazası kayıtları olmasıdır. Bu verilerle ilgili olarak en uygun zaman serisi modeli belirlenmiş ve trafik kazalarında periyodik bileşenlerin olup olmadığı incelenmiştir. Verilerin birinci dereceden entegre olduğu görülmektedir. Bu durumda serinin birinci dereceden farkı istatistiksel sonuç açısından alınmıştır. Serinin grafikleri incelendiğinde, serilerde olası periyodikliğin bulunabileceği varsayımı ile Akdi ve Dickey (1998) tarafından önerilen periodogram temelli birim kök testi ile serinin durağanlığı da test edilmiş ve serinin % 10 anlamlılık düzeyinde durağan olduğu görülmüştür. Elde edilen sonuçlara göre 2019 yılında günlük trafik kaza sayılarında 33, 36.5 ve 73 günlük dönemlerin önemli olduğu tespit edilmiştir. 73 günlük sürenin Ramazan Bayramı ile Kurban Bayramı arasındaki döneme denk geldiği (iki dini bayram arasında 70 günlük bir ara vardır) gösterilmiştir.

- «

- 1 (current)

- 2

- 3

- »